are 529 contributions tax deductible in oregon

529 Qualified State Tuition Plans are entered at state level. And Oregon residents with out-of-state family members contributing to your childs 529 can take a deduction or credit for those out-of-state contributions on their Oregon taxes.

Tax Benefits Oregon College Savings Plan

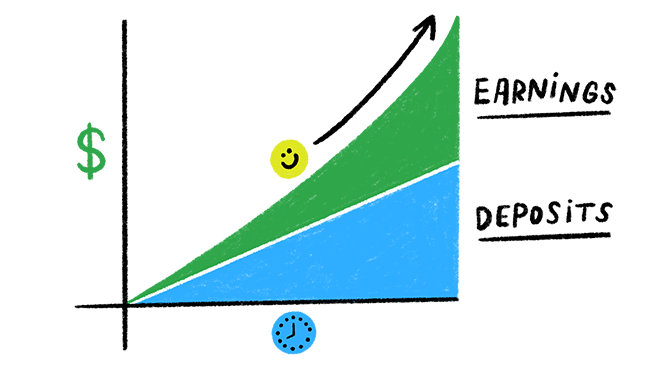

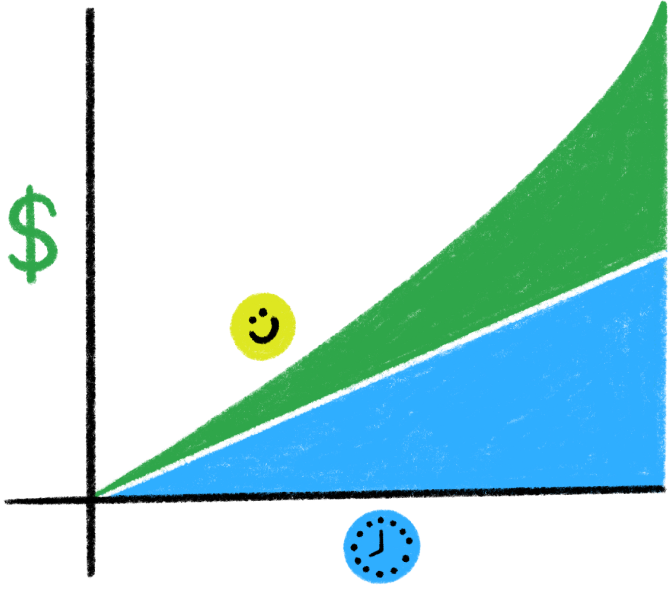

You also get federal income tax benefits as you do not pay income tax on your earnings.

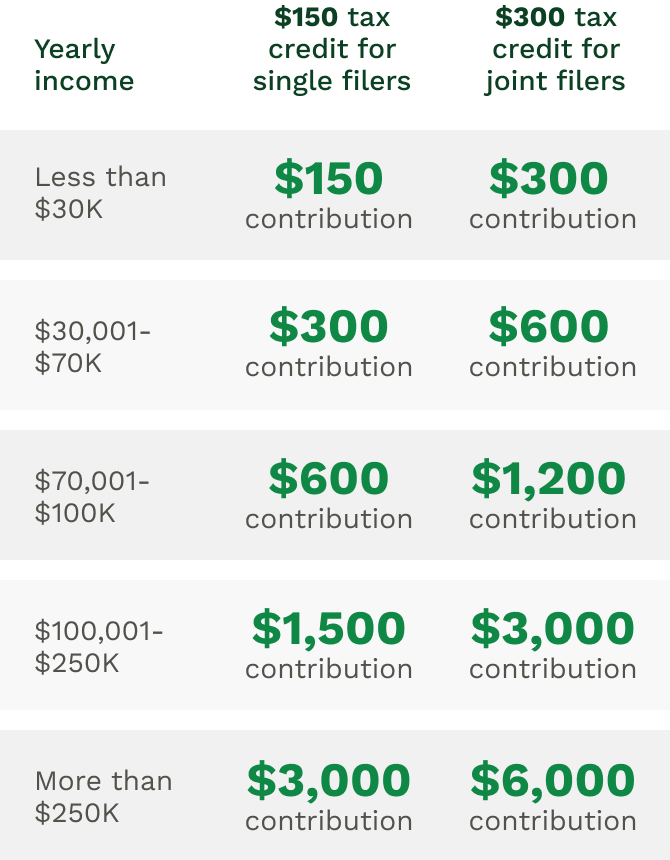

. Maximum aggregate plan balance. The credit is up to 300 for joint filers and up to 150 for individuals. See How You Could Pay Less Taxes Through Tax Deductions Tax-Free Withdrawals and More.

Families can deduct up to 4865 worth of these contributions from their state tax returns. 529 plan contributions arent typically tax-deductible but they are exempt from federal and state taxes when used for qualified higher education expenses tuition room and board textbooks or other expenses related to secondary education enrollment. And Oregonians can still take advantage of this perk based on the contributions they made before December 31 2019.

Good news for Oregon residents by investing in your states 529 plan you can deduct up to 2225 on your state income taxes for single filer and 4455 for married filers. Credit recaptures for Oregon 529 College Savings Network and ABLE account contributions. You do not need to be the owner of the account to contribute and claim the tax credit.

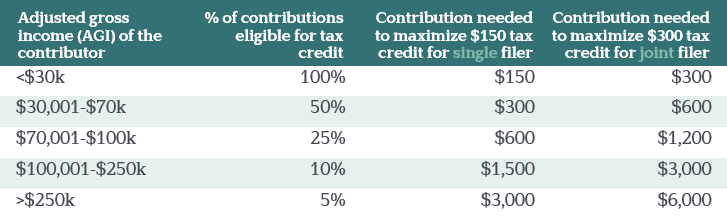

Same subtraction codes 324 for 529 plans 360 for ABLE. The percentage of contributions eligible for credit varies based on income. Earnings from 529 plans are not subject to federal tax and generally not subject to state tax when used for qualified education expenses such as tuition fees books as well as room and board.

Although contributions are not deductible earnings in a 529 plan grow federal tax-free and will not be taxed when the money is taken out to pay for college. Previously Oregon allowed tax-deductible contributions. 4960 for MFJ 2480 all others.

Below is a list of all the states that have a line for the Qualified Tuition Plans. For more on the changes to the Oregon plan continue reading OR 529 Part 2 here. Oregon gives a tax credit for 529 contributions.

The contributions made to the 529 plan however are not deductible. This means that if you withdrew funds for non-qualified expenses from your Oregon College Savings Plan account and you. Even though every state has a plan they are not all the same.

Oregon 529 College Savings and ABLE account plans. Contributions and rollover contributions up to 2435 for a single return and up to 4865 for a joint return are deductible in computing Oregon taxable income. If you are a resident of Oregon contributions made to any account in the Oregon College Savings Plan are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers.

The contributions made to the 529 plan however are not deductible. The credit is up to 300 for joint filers and up to 150 for individuals. All Oregon tax payers are eligible to contribute to an Oregon College Savings Plan MFS 529 Savings Plan or Oregon ABLE Savings Plan and claim the state tax credit.

For more information about 529 Contributions visit. If you claimed a tax credit based on your contributions to an Oregon College or MFS 529 Savings Plan account or an ABLE account and later made a nonqualified withdrawal of those contributions your credits may have to be recaptured. Excess contributions made on or before December 31 2019.

In the past contributions to the Oregon 529 Plan were deductible on your Oregon state income tax return up to certain limits. Where do I enter contributions for 529 College Savings Program in a 1040 return using worksheet view. The new tax credit would be in addition to any carried forward deductions.

For more information about 529 Contributions visit. Single filers can deduct up to 2435. 4 rows Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan.

The 2021 tax year only 529 plan contributions were deductible Oregon Yes Yes Maximum credit of 150 for individuals and 300 for joint filers per year for contributions to Oregon plans. See Additions to tax in Publication. Earnings from 529 plans are not subject to federal tax and generally not subject to state tax when used for qualified education expenses such as tuition fees books as well as room and board.

Full amount of contribution. Although theres no federal tax deduction for 529 contributions most states offer some kind of tax break or other incentive to contribute to their college savings plans. Ad The Vanguard 529 College Savings Plan Could Help You Save Money on Taxes in The Long Term.

Can claim subtraction and credit on same return. And as with any 529 plan your money grows. 529 plans offer unsurpassed income tax breaks.

Subject to annual limits. In 2019 individual taxpayers were allowed to deduct up to 2435 for contributions made to the Oregon College Savings Plan while those filing jointly could deduct 4865. 529 plans typically increase the contribution limit over time so you may be able to contribute more.

Its up to you to keep records showing the contribution in the event of an audit. Do you get a tax deduction for 529 contributions.

مدارک ثبت نام آزمون مدارس تیزهوشان 99 98 529 Plan Saving Money How To Plan

How Much Is Your State S 529 Plan Tax Deduction Really Worth

Tax Benefits Oregon College Savings Plan

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar State Tax College Savings Plans 529 College Savings Plan

Paul Curley Cfa Youtube 529 College Savings Plan College Savings Plans Saving For College

Tax Benefits Oregon College Savings Plan

من سيكون كبش الفداء في جنون الدولار No Credit Loans Loans For Bad Credit Bad Credit

How Do I Choose A 529 Morningstar 529 College Savings Plan Saving For College How To Plan

Tax Benefits Oregon College Savings Plan

Which States Pay The Highest Taxes Family Money Saving Business Tax Economy Infographic

529 Plans Which States Reward College Savers Adviser Investments

Oregon College Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Tax Benefits Oregon College Savings Plan

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

Tax Benefits Oregon College Savings Plan

How Much Can You Contribute To A 529 Plan In 2021

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management